In this blog article, we’re talking about how renewable energy is more cost-effective than ever before, more and more companies are making the switch to renewables, and that we need to start talking about how to push for policies that will make the transition into renewable energy easier.

What is an energy tax credit?

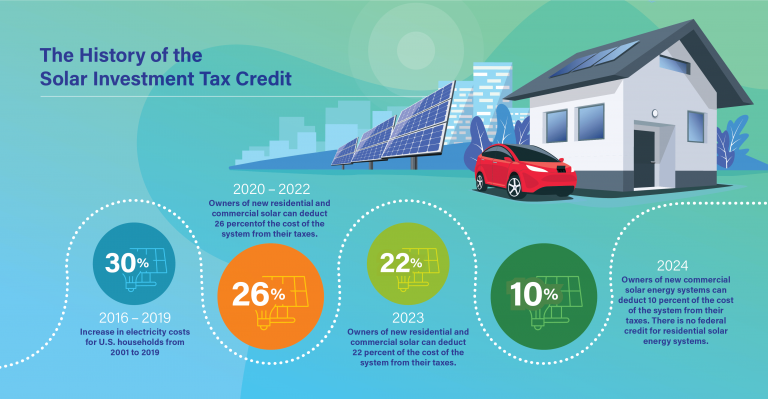

The tax credit for renewable energy is a Federal tax incentive offered to individuals, businesses, and property owners who install or upgrade solar and wind power systems. Called the Solar Investment Tax Credit (ITC) and the Wind Production Tax Credit (PTC), these credits are available to individuals and businesses that own or lease property that produces energy from solar or wind systems. The credit is based on the amount of electricity produced by the system, not the cost of the system. For wind installations, the ITC is reduced by 30% for every 100 kWh of electricity produced over 1,000 kWh. The PTC is reduced by 20% for every 100 kW of installed wind capacity.

The tax credit expires at the end of 2019, but can be extended through 2020 if Congress approves a bill in this session. filemytaxesonline.org

To claim your deduction, you must file your federal income taxes with Form 8233, Energy Credit Carryover Certificate. Claimants must also attach Form 4563, Photovoltaic System Property Tax Credit Declaration to their return. More information about claiming the credit can be found on IRS.gov

The Renewable Energy Tax Credit

Renewable energy has the potential to drastically reduce greenhouse gas emissions, and as a result, the government is investing in renewable energy. In order to promote renewable energy, the federal government has created the Renewable energy tax credit. The credit provides a tax incentive for individuals and businesses to invest in renewable energy. The credit can be used to purchase renewable energy resources, such as solar panels or wind turbines. The credit is available for both residential and commercial projects. To qualify for the credit, projects must be completed by 2020. For more information about the Renewable Energy Tax Credit, visit the IRS website.

How does the renewable energy tax credit work?

The renewable energy tax credit (RETC) is a federal incentive program that provides a tax credit to individuals and businesses that install renewable energy systems. The credit is based on the amount of electricity produced from renewable sources, such as solar, wind, biomass, and hydroelectric power.

The 2016 federal fiscal year ended on September 30th. You can begin claiming the RETC for your 2016 tax returns by filing your return by April 15th, 2017. The 2017 federal fiscal year begins on October 1st so you have until April 15th, 2018 to claim the credit.

Breakdown:

You can receive a tax credit for either residential or commercial installations of renewable energy systems. The amount of the credit is based on the kilowatt hours produced from the system. In order to qualify for the credit, you must include information about your installation in your tax return. The maximum credit you can receive is $5,000 per installation. This means that you could receive a total of $20,000 in credits for your residential and commercial installations during the 2016 fiscal year.

If you install a system after December 31st, 2017 but before April 15th, 2018 you can still claim the full $5,000 per

Who can receive the renewable energy tax credit?

The tax credit for renewable energy allows businesses and individuals to receive a tax credit for the purchase of solar, wind, geothermal, or hydroelectric power. The credit is based on the amount of electricity generated from renewable sources and can be as high as 30%.

Who is eligible for the renewable energy tax credit?

The renewable energy tax credit is available to businesses and individuals who purchase or lease solar, wind, geothermal, or hydroelectric power. The credit is not available for purchases of biomass power.

How much can I receive?

The maximum amount you can receive for the purchase of solar, wind, geothermal, or hydroelectric power is 30% of the cost of the electricity generated. The maximum amount you can receive for the lease of solar, wind, geothermal, or hydroelectric power is 50% of the cost of the electricity generated. The maximum amount you can receive for the purchase of biomass power is $2 million per year.

Where can you find out if you qualify for the renewable energy tax credit?

If you’ve installed solar panels or wind turbines in the past two years and your property is used to generate electricity, you may be able to take advantage of the renewable energy tax credit. The credit is available for both solar and wind installations, and it can reduce your federal taxes by up to 30 percent. To qualify, you must have paid at least $1,000 in expenses related to your installation, such as installation fees, materials, and professional services.

Apart from that if you want to know about then visit our Real Estate category.